How Does Our Government Money Go To Schools

Financial Transparency Regulatory

How Land & Local Dollars Fund Public Schools

Public schools are primarily funded through holding tax dollars and other country and local taxes, but the way tax dollars travel to schools can be confusing.

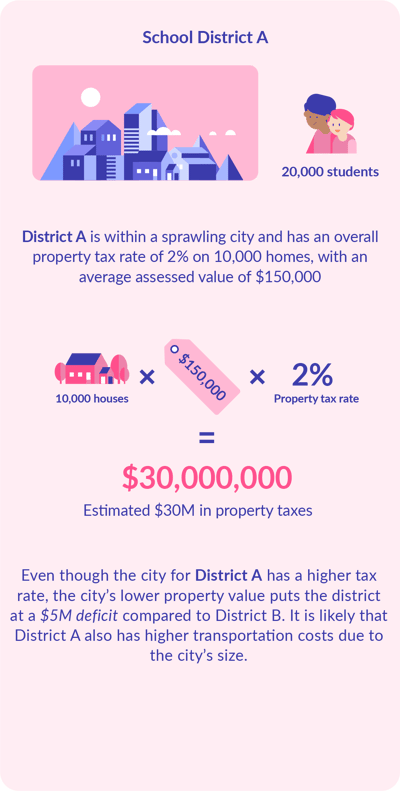

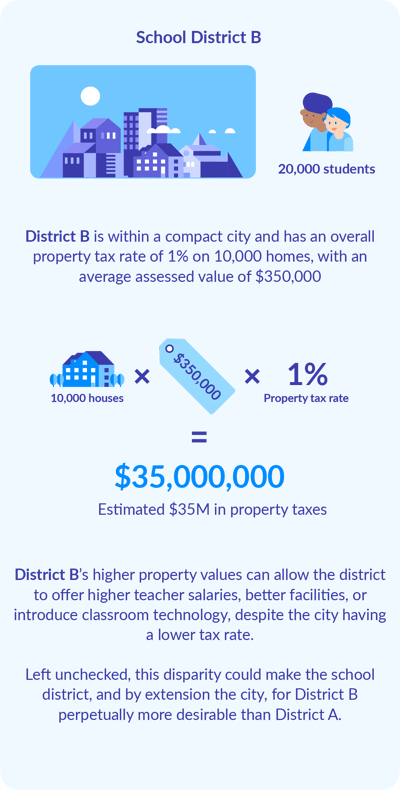

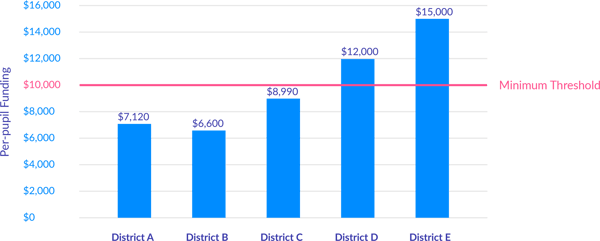

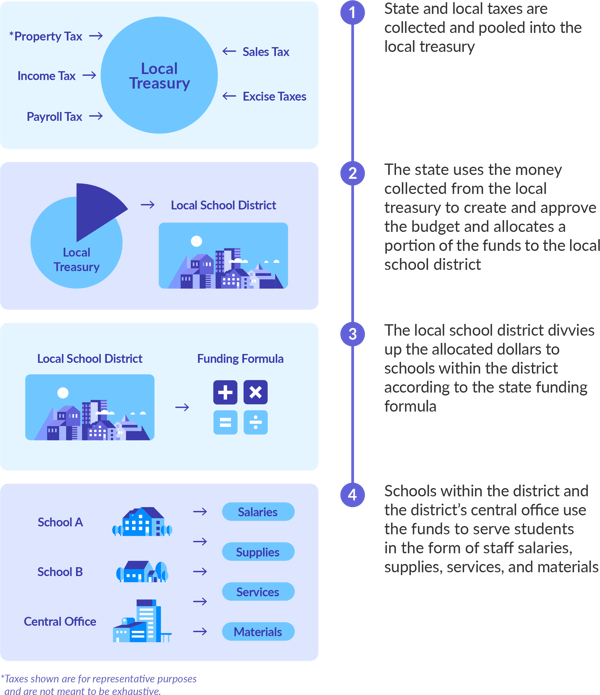

Taxation dollars are not necessarily allocated to students or even to schools in the neighborhoods of the taxpayer. Taxation revenue is collected and distributed to schools throughout a commune, and in a growing number of states, to districts throughout the state. Funding for public school districts primarily comes from state (i.east., sales tax, income revenue enhancement) and local tax revenue (i.due east., property revenue enhancement), with less than 10% of funding coming from federal funds. The proportion of revenue a school receives from local and state funding differs across each state and depends upon: 1) whether local government distributes dollars direct to the school arrangement or sends funds dorsum to the state for distribution, 2) the land funding formula, and 3) local municipal revenue sources and budgetary allocations to education. Regardless of the distribution process, the amount of taxation dollars that are allocated to schools depends on how the local government generates revenue. 1. How does local government generate revenue? ii. How does the land allocate funds to school districts? 3. Where do your state and local tax dollars go? Local revenue is generated by a combination of property tax, sales tax, and income tax, and is a major funding source for many school districts across the land. Terms to know: Holding taxes are subject to assessed value calculations, millage rates, and tax policies of personal- or privately-owned properties. Though this primarily includes residences and businesses, information technology sometimes includes vehicles and other forms of personal property. Public- or regime-endemic buildings, structures, and parks are mostly excluded from property tax calculations. Property taxes can vary state-to-state, urban center-to-city, and those variances can create inequities based largely on the affluence of a zip code. The amount of revenue generated past belongings taxes too depends on the municipality's ability to collect those taxes. If a urban center is only able to collect a portion of owed property taxes from businesses and individuals, the reduced revenue volition impact the amount of funds available to allocate to school districts. How property taxes impact school district revenues School District A and School District B are located in neighboring cities in the same state. Many cities offering tax abatements to prospective employers in lodge to generate new concern and employment opportunities for its residents. New business backdrop with granted taxation abatements oftentimes go untaxed for a specified number of years, fifty-fifty decades, despite having an assessed value and stated millage rates. These incentives permit new businesses to build and thrive within local communities without directly contributing to the communities' assessed value, thus lowering the overall tax-base, expected revenue, and public benefits that would take come from the boosted revenue. Some districts generate additional local revenue using a bail/levy. Schoolhouse bonds are essentially loans that let the district to fund large capital projects like building new schools or renovating older school buildings. These low-take chances bonds are issued and sold on the bail market and can provide tax-free gains to the purchaser. The school commune, in return, levies a college millage charge per unit on the public in the form of temporarily higher taxes to pay dorsum the value and interest on the bonds. The possibility of higher taxes means bonds are normally voted on past the local public earlier they tin be issued. Some states develop funding formulas designed to fill the gap between what can be raised locally and the bones level of funding required for schools. However, these formulas are often complex, impacted by political influences, and are generally not nuanced enough to finer back up every local context. To identify potential gaps in funding, almost states use forecasted data sets to project how much a local municipality could generate in funds. The land distributes funds based on these projections with the goal of leveling the playing field for all students inside that state. However, if the state estimates higher or lower property tax revenue than what is likely for a particular locale, it could adversely affect the district's funding potential. A land that only ensures that each district reaches the minimum threshold for education may do well to reduce local funding gaps, but will non effectively eliminate them. Example: A land has five districts for which it provides supplemental funding. This state uses a unproblematic funding formula that identifies $x,000 per-pupil as the minimum threshold needed to operate a district. District A can only raise $7,120 locally; District B, $half-dozen,600 locally; District C, $8,990; while Districts D and E accept both raised beyond the minimum threshold at $12,000 and $15,000, respectively. A state funding formula that focuses on bringing districts A, B, and C up to the minimum threshold will help narrow the gaps across the five districts, only notwithstanding may not exist equitable. Additionally, schools A, B, and C will still exist funded at significantly lower levels when compared to Districts D and East. Equality does not create equity. $x,000 at a district with a higher-price-to-serve student population may not go as far every bit $10,000 at a district with a lower-price-to-serve pupil population. The planned and collected revenues, including acquirement earmarked for schools, are approaching to the local instruction agency through the local regime's budget adoption procedure. The process typically includes community comment and voting by elected officials at budget hearings. One time the budget is completed and canonical, the dollars are sent to the local pedagogy agency, normally on an annual or biannual timeframe (states similarly allocate their budgeted dollars to school districts annually or biannually), for distribution to schools. Once dollars are allocated to a school district, the commune is responsible for amalgam its ain upkeep and having its upkeep approved by a school board or district council. This budget details where dollars will become within the schoolhouse system, including central part departments, schools, facilities, and capital projects. The infographic below tin can help taxpayers better understand the 'why' backside the pathway of the dollar from their pockets into student's backpacks.

one. How does local authorities generate revenue?

Property Taxation

Each district enrolls 20,000 students and each receives 100% of the revenue generated from the property taxes levied.

Tax Abatements

Bonds

2. How does the country classify funds to school districts?

3. Where do your country and local taxation dollars go?

Source: https://blog.allovue.com/alloversity/how-state-local-dollars-fund-public-schools

Posted by: meyerscamonwarld.blogspot.com

0 Response to "How Does Our Government Money Go To Schools"

Post a Comment