How Much Tax Money Was Spent On The Obamas In 2017

February. 11, 2016 - Download PDF Version

New proposal calls for investment in domestic priorities only also prioritizes Pentagon spending and armed services force.

By: Jasmine Tucker and Lindsay Koshgarian

Americans rightly look certain things of our government: clean, safe drinking water and air, an pedagogy system that works, and a system that allows anyone to succeed.

Just those priorities aren't always what we see if we look at our federal budget. Too often, we come across a upkeep that benefits special interests at the expense of ordinary people. And more than half of discretionary spending is reserved for the Pentagon, war, and related costs. What's more: about half of Pentagon spending has been captured by for-profit contractors. Meanwhile, proposals that would do good Americans, like free community college, receive petty or no consideration past our current Congress.

President Obama's final budget proposal calls for increased investment in education, the fight against climate change, and family-friendly tax policies, all of which enjoy broad pop support. However, it likewise calls for connected windfalls for the Pentagon that will benefit for-turn a profit contractors without calculation to our security.

Hither are highlights of what the new budget proposal contains:

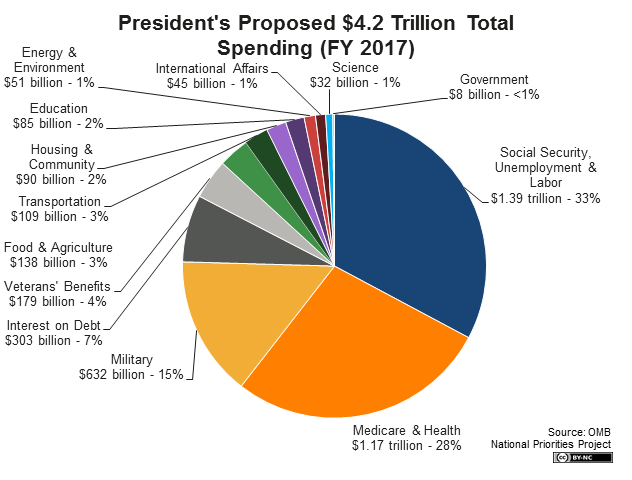

Total Spending

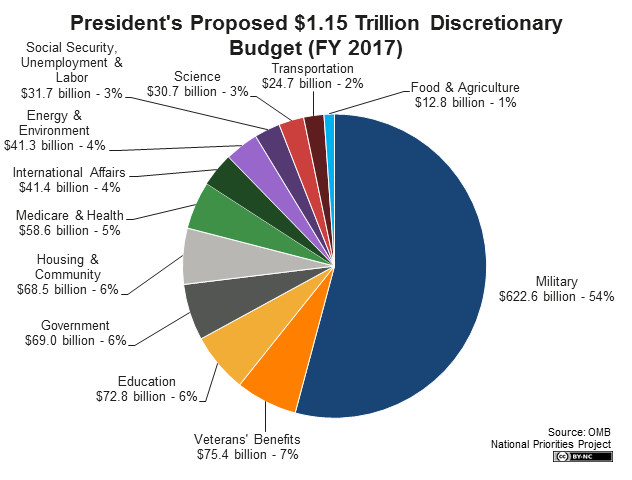

The president's proposal calls for $4.2 trillion in federal authorities spending in 2017, representing a iv percentage increase over 2016 total spending. Of that, $1.15 trillion is for the discretionary spending upkeep that Congress legislates each year, and nearly $2.viii billion would exist for mandatory spending authorized past existing constabulary.

Compared to 2016, discretionary spending would decrease in every category except veterans' benefits and labor – including education, science and international affairs. Mandatory spending would increase by more than than v pct over 2016, with the biggest increases in Social Security, transportation, and Medicare.

Of the discretionary spending total, $622.half-dozen billion, or 54 percent, would be gear up aside for the Pentagon, nuclear weapons and related items. The next biggest category of discretionary spending would exist veterans' benefits, receiving an additional $75.4 billion. These two categories full nearly 61 percentage of the total discretionary budget. The remaining 39 percent would fund education, housing and customs programs, science, the environment, and more than.

Economic Inequality and Opportunity

The budget includes proposals that would explicitly create economical opportunity, or help to amend the effects of growing inequality, including:

- Nearly $6 billion in new funding to connect young, asunder Americans to their first job. The plan would assistance nearly ane million young people get summertime jobs, and an additional 150,000 young people to find employment for up to a yr;

- An indefinite expansion of the Affordable Care Act'southward iii years of full federal support for Medicaid expansion past states. Nineteen states accept chosen not to expand Medicaid coverage under the Affordable Care Human activity. The toll of the proposal would depend on how many of these states cull to extend assist to struggling Americans;

- A make clean transportation package totaling $32 billion per year over 10 years that would create hundreds of thousands of heart-class jobs in an economy that still doesn't provide enough opportunities for practiced-paying work.

Education

A strong education system is a clear prerequisite to a off-white economy with equal opportunity for all. Americans consistently say that more investment in education is among their top priorities for our government.

The president's budget proposal includes a number of targeted proposals for increasing pedagogy funding, including:

- Ii free years of community higher, a federal-land initiative that would toll the federal government $61 billion over 10 years – which the current Congress failed to have up last year.

- Increasing Pell grant funding by $two billion, in stark contrast to congressional proposals to freeze or cut funding to the program for the everyman-income college students.

- Continuing support for the president's signature Preschool for All programme, a federal-state partnership that provides preschool support for the everyman income four-year olds.

- Modest increases in funding to other federal preschool programs, including a $434 million increase for Caput Start over 2016 figures, to a total of $9.6 billion in 2017;

- $4 billion over 3 years in new Science, Engineering, Applied science, and Math (STEM) funding for K-12 education.

Climate change

The upkeep proposes to double make clean energy inquiry and development to a level of $12.viii billion by 2021.

The proposed $32 billion per year to improve our nation's transportation systems is likewise intended every bit a climate change measure out, and would include investments such every bit:

- Providing $10 billion per year for transit improvements;

- A $seven billion per year investment in high speed rail;

- A $two billion per year investment in cleaner vehicles and aircraft.

Pentagon and Related Spending

The budget maintains the status quo, with more than half of discretionary funding (the funding Congress allocates each twelvemonth during its budget procedure) reserved for the Pentagon and spending on nuclear weapons and related items. Total Pentagon and related spending in the asking amounts to virtually$623 billion, including the Pentagon budget, nuclear weapons and help to foreign militaries. The budget provides $583 billion for the Pentagon alone in 2017, a $two billion increase over 2016.

Pentagon funding of $583 billion includes:

- A $59 billion 2017 Pentagon slush fund, or Overseas Contingency Operations (OCO) funding – a fund that began as an Iraq and Afghanistan war fund and has since morphed into a Pentagon petty cash jar, and which permits the Pentagon to bust through legislated budget caps;

- Merely $vii.5 billion, less than two pct of the Pentagon'south total budget, for fighting ISIS, making clear that fifty-fifty real terrorist threats are often cynically used to secure billions in unrelated Pentagon funding;

- Quadrupled funding, or $3.4 billion, for the European Reassurance Initiative, recommitting the United States to military machine involvement in a conflict where our ability to brand a positive difference is highly questionable.

The Pentagon budget is more than than x times the upkeep allocated for diplomacy under the Department of State, which is $52.7 billion in 2017. In that location are often effective alternatives to war, just we too often practice not employ them. Compared to $seven.five billion for armed services efforts against ISIS, the budget provides only $four billion for dedicated diplomacy and humanitarian relief effectually the region.

Meanwhile, in addition to the $583 billion Pentagon upkeep, the president's request includes:

- $xix billion for nuclear weapons and related activities;

- $13 billion for foreign military assistance;

- $eight billion for additional "defence force-related activities."

Unemployment Insurance

The president's budget proposes reforms to modernize the Unemployment Insurance (UI) program then that more than workers are covered and for longer periods of time.

Proposals include:

- Requiring that each state provide a minimum of 26 weeks of state benefits (ix states currently provide less);

- Expanding benefits to embrace millions of part-time workers and those who must leave a job for compelling family reasons;

- Expanding UI'south federal extended benefits program to provide upwardly to 52 weeks of additional federal benefits for states with higher than average unemployment rates.

Social Security and Medicare

As in 2016, the president'due south 2017 proposal would close loopholes that permit some high-income individuals to avoid Medicare and Social Security payroll taxes, which could provide as much as $10 billion more than in acquirement per year past the finish of the decade.

The upkeep also proposes certain reforms to the Medicare program that would extend the solvency of Medicare Office A - the Infirmary Insurance trust fund - past an additional 15 years. The program is currently fully funded until 2030. The president's plan would lower prescription drug costs under Medicare Part D and introduce a co-payment for beneficiaries who receive home health care services, among other reforms.

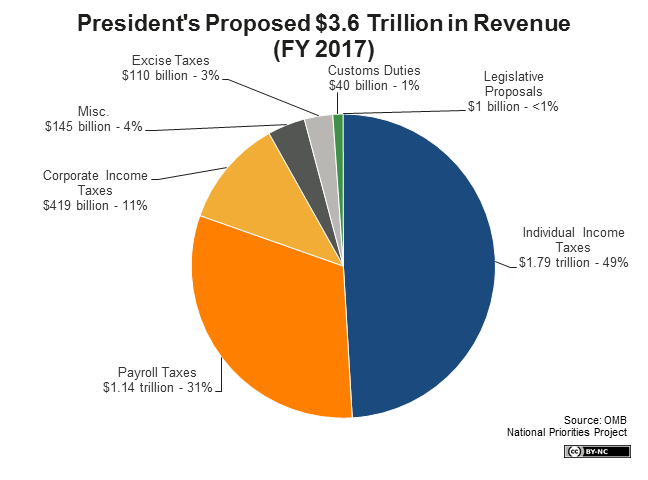

Taxes and Revenues

The president's upkeep proposal projects$3.6 trillion in total tax acquirement in fiscal year 2017, and includes proposals that focus on raising boosted revenue and increasing fairness and transparency in the revenue enhancement arrangement. Many of these would be very popular amidst Americans, who believe the wealthy and corporations don't pay plenty in taxes.

The proposal would enhance $955 billion over ten years by closing certain loopholes for wealthy taxpayers. For example, it would:

- Raise the top tax rate on uppercase gains (currently 20 percent) to equal the rate nether President Reagan (28 per centum) and close certain tax loopholes on private investments;

- Limit the value of sure deductions to 28 percent;

- Close the "carried involvement" loophole, among other revenue enhancement breaks;

- Implement the "Buffet Rule," ensuring that the wealthiest Americans pay at to the lowest degree 30 percentage in income taxes even afterward they've availed themselves of the numerous taxation loopholes available to them.

These reforms would brand taxation on the wealthy more in line with the taxation of income earned by lower- and middle-income Americans.

The president also proposed measures to require corporations to pay their fair share. In combination these measures would increase corporate tax revenues from $298 billion in 2016 to near $419 billion in 2017. These measures include:

- A new fee for large financial institutions – roughly 100 firms with avails of more than than $50 billion – that would discourage excessive gamble-taking and raise $111 billion over ten years in new acquirement.

- Requiring companies to pay taxes on income earned abroad, which would prevent U.South. companies from "inverting," a maneuver where American corporations arrange to exist purchased by smaller overseas corporations to avoid paying U.S. taxes.

The plan wouldn't only raise more acquirement. It would as well use the tax lawmaking to gainsay economical inequality directly, by building upon improvements fabricated to the Earned Income Tax Credit (EITC) under the American Recovery and Reinvestment Act (ARRA) to expand EITC benefits for childless workers. It would increment the size of the credit and provide the credit to more workers based on income and historic period.

Budget Deficit

The president's upkeep proposal would run a deficit of $503 billion in fiscal year 2017, downwardly from $616 billion in 2016. The plan would reach $two.9 trillion in deficit reduction over ten years from various wellness, immigration, and tax reforms, including $955 billion over ten years from closing sure loopholes for wealthy taxpayers.

Every bit a share of the economy, the arrears is projected to be 2.half-dozen percent of the economy in 2017, downwards from a high of 10 percent in 2009 post-obit the Great Recession. The president proposes to limit deficits to less than 3 percent of the economy over the side by side ten years, which is on par with recent history: over the last 50 years, budget deficits have averaged 2.9 percent of the economy.

What Is the President's Budget Request?

Federal law requires that the president submit a budget proposal to Congress every February, which serves equally a starting point for negotiations in Congress. The proposal begins the almanac federal budget procedure that creates the upkeep for the coming fiscal twelvemonth, which begins on Oct. 1. For more on who decides the federal upkeep, see Federal Budget 101.

Why Does the President's Budget Matter?

Though the budget ultimately enacted by Congress may look very different from the budget request released by the president, the president'south budget is important. It's the president's vision for the country in financial twelvemonth 2017 and beyond, and it reflects input and spending requests from every federal bureau. At a time of conflict over federal spending, the president's budget is largely a political document – but an important one, because it shows the president's priorities in item. It also serves every bit a benchmark confronting which all subsequent spending legislation will exist measured.

Source: https://www.nationalpriorities.org/analysis/2016/president-obamas-2017-budget/

Posted by: meyerscamonwarld.blogspot.com

0 Response to "How Much Tax Money Was Spent On The Obamas In 2017"

Post a Comment